UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨þ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11c or Section 240.14a-12

AGILYSYS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check the appropriate box):

| |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

Payment of Filing Fee (Check the appropriate box):

| |

| ¨ | Fee paid previously with preliminary materials. |

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form of Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

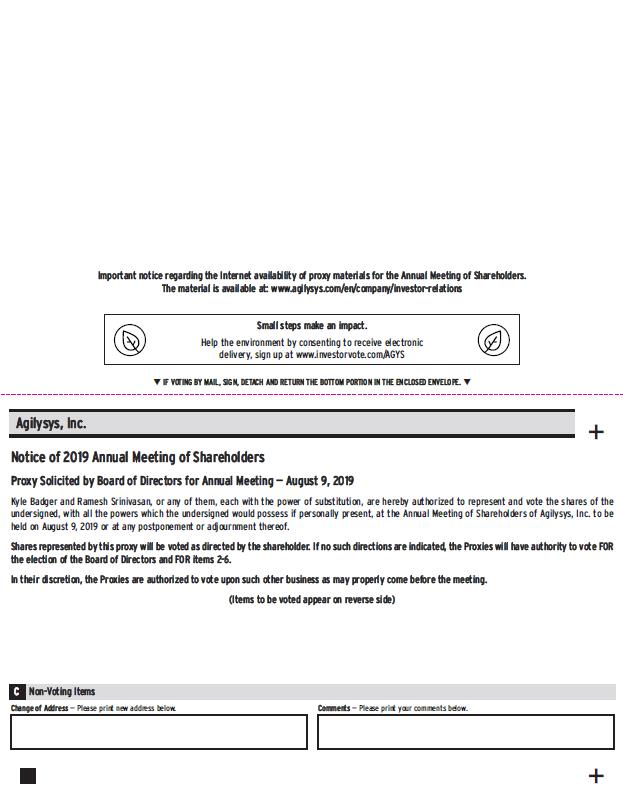

NOTICE OF 20172019 ANNUAL MEETING OF SHAREHOLDERS

To be held on August 16, 20179, 2019

Please join us for the Agilysys, Inc. 20172019 Annual Meeting of Shareholders to be held on Wednesday,Thursday, August 16, 2017,9, 2019, at 8:00 a.m., local time, at the company’s offices 5383 Hollister Avenue,3380 146th Place SE, Suite 120, Santa Barbara, California 93111400, Bellevue, Washington 98007.

The purposes of the Annual Meeting are:

| |

| 1. | To elect the director nominees named in the attached Proxy Statement; |

| |

| 2. | To approve amendments to the Company’s Amended Code of Regulations and Amended Articles of Incorporation to require a majority vote, in uncontested elections, for director nominees to be elected; |

| |

| 3. | To approve an amendment to the Company’s Amended Code of Regulations to reduce the threshold for shareholder removal of a director from a two-thirds supermajority to a simple majority; |

| |

| 4. | To vote, on a non-binding advisory basis, to approve the compensation of our named executive officers set forth in the Proxy Statement; |

| |

3.5. | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2018;2020; and |

| |

4.6. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Shareholders of record at the close of business on July 7, 2017,June 25, 2019, are entitled to vote at the Annual Meeting. It is important to vote your shares at the Annual Meeting, regardless of whether you plan to attend. In addition to voting by mail, you may vote by telephone or Internet.internet. Please refer to your enclosed proxy card and the Proxy Statement for information regarding how to vote by telephone or Internet.internet. If you choose to vote by mail, please sign, date, and promptly return your proxy card in the enclosed envelope.

By Order of the Board of Directors,

Michael A. Kaufman

Chairman of the Board of Directors

July 18, 2017[ ], 2019

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to be held on August 16, 2017.9, 2019.

The Proxy Statement and our Annual Report on Form 10-K for the

fiscal year ended March 31, 2017,2019, are available at www.agilysys.com.

PROXY STATEMENT

20172019 ANNUAL MEETING OF SHAREHOLDERS

August 16, 20179, 2019

ANNUAL MEETING INFORMATION

General Information

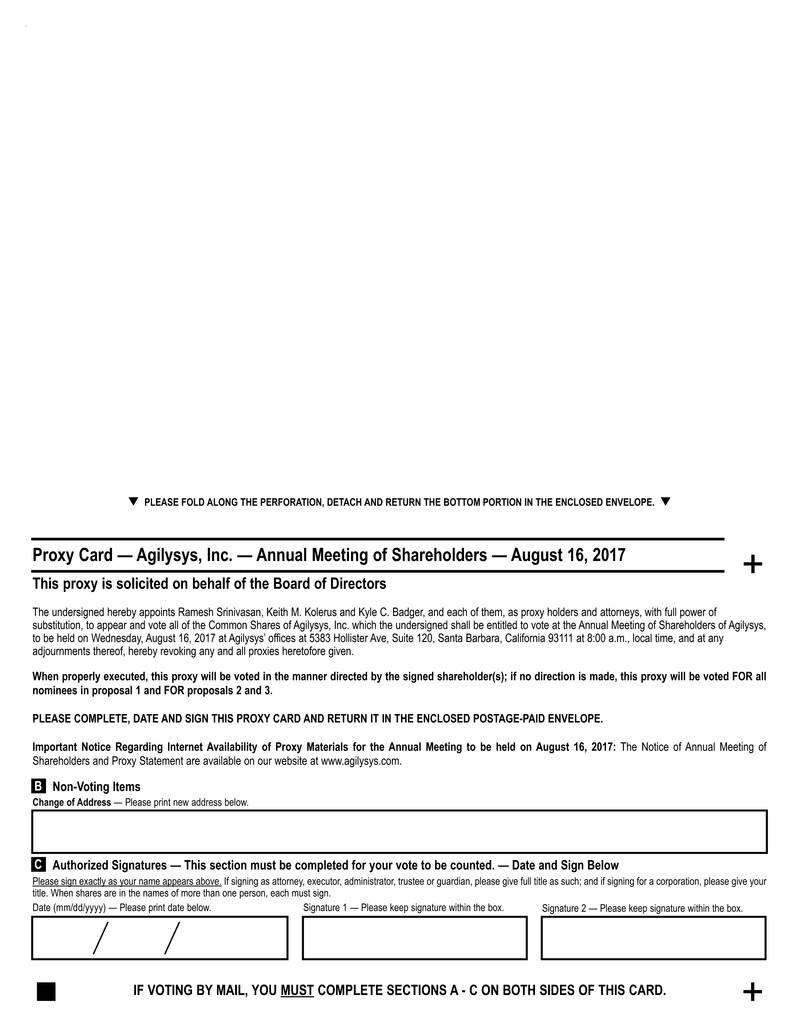

This Proxy Statement and the enclosed proxy card are being provided in connection with the solicitation by the board of directors of Agilysys, Inc., an Ohio Corporation (“Agilysys,” the “Company,” “we,” “our,” or “us”), to be used at the Annual Meeting of Shareholders to be held on August 16, 2017,9, 2019, , and any adjournments or postponements of the Annual Meeting. The Annual Meeting will be held at 8:00 a.m., local time, at the Company’s offices at 5383 Hollister Avenue,3380 146th Place SE, Suite 120, Santa Barbara, California 93111.400, Bellevue, Washington 98007. Our principal executive office is located at 425 Walnut Street,1000 Windward Concourse, Suite 1800, Cincinnati, Ohio 45202.250, Alpharetta, Georgia 30005. The purposes of the Annual Meeting are stated in the accompanying Notice. This Proxy Statement, the enclosed proxy card, and our Annual Report on Form 10-K for the fiscal year ended March 31, 20172019 (“20172019 Annual Report”), are first being mailed to shareholders and made available electronically on our website at www.agilysys.com beginning on or about July 18, 2017.[ ], 2019.

Record Date, Voting Shares, and Quorum

Shareholders of record of our common shares at the close of business on July 7, 2017,June 25, 2019, the “Record Date,” are entitled to notice of and to vote their shares at the Annual Meeting, or any adjournment or postponement of the Annual Meeting. On the Record Date, there were 23,327,815[23,495,028] common shares outstanding and entitled to vote at the Annual Meeting.vote. Each share is entitled to one vote. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the common shares outstanding at the close of business on the Record Date will constitute a quorum for the transaction of business at the Annual Meeting. We will include abstentions and broker non-votes in the number of common shares present at the Annual Meeting for purposes of determining a quorum. A broker non-vote occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares. Our common shares are listed on the NASDAQ Global Select Market under the symbol “AGYS.”AGYS. References within this Proxy Statement to our common shares or shares refer to our common shares, without par value, the only class of securities entitled to vote at the Annual Meeting.

How to Vote

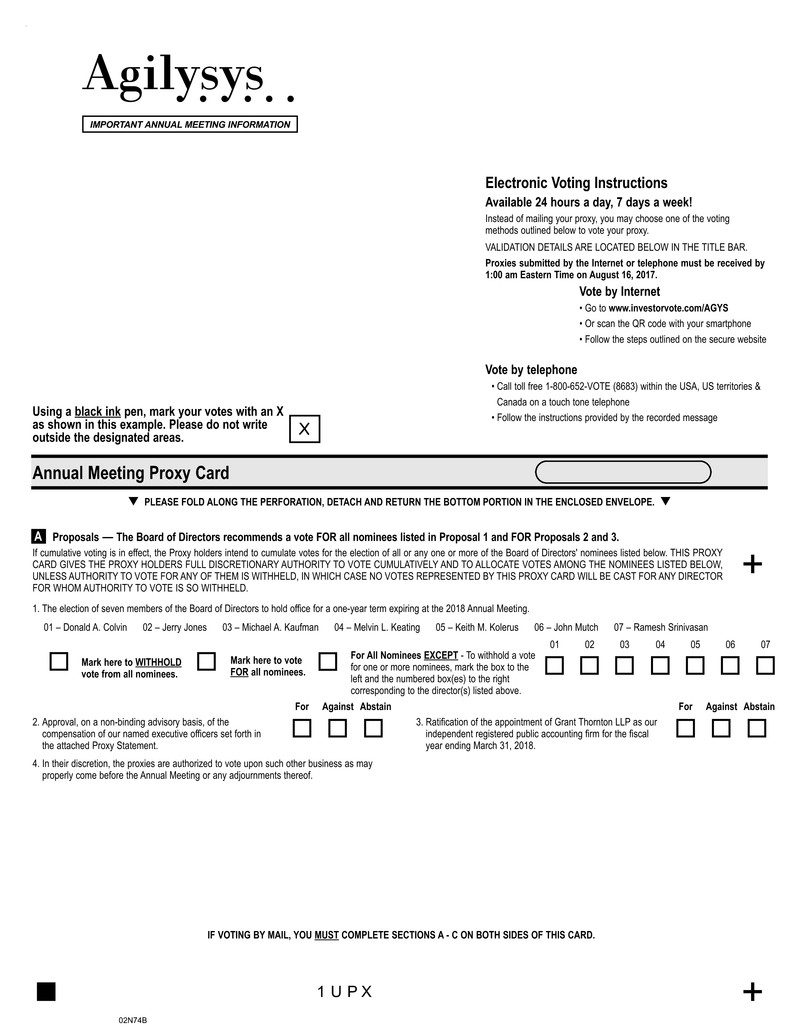

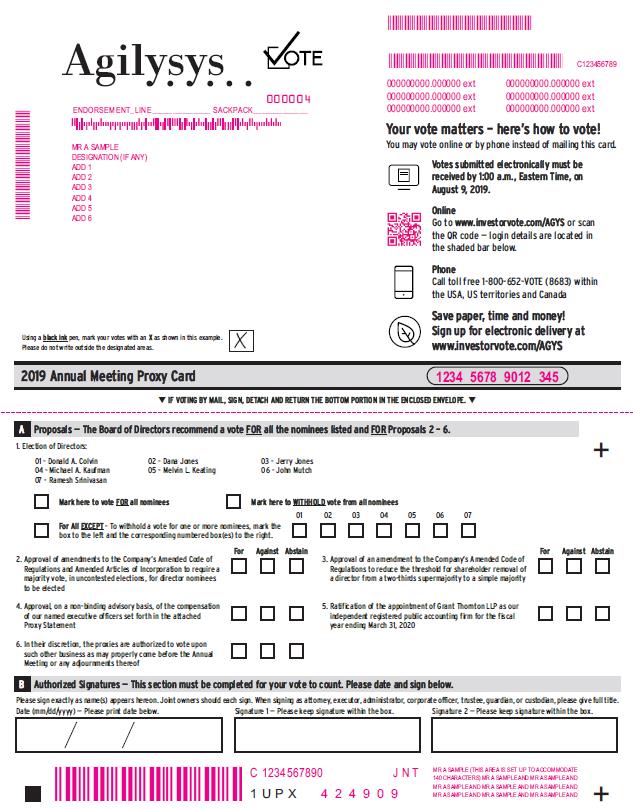

If you are the record holder of common shares, you or your duly authorized agent may vote by completing and returning the enclosed proxy card in the envelope provided. This year, youYou may also vote by telephone or Internet.internet. Telephone and Internetinternet voting information is provided on your proxy card. A control number, located on the proxy card, is designed to verify your identity, allow you to vote your shares, and confirm that your voting instructions have been properly recorded. Please note the deadlines for voting by telephone, the Internet,internet, and proxy card as set forth on the proxy card. If you vote by telephone or Internet,internet, you need not return your proxy card. You may also attend the Annual Meeting and vote in person; however, we encourage you to vote your shares in advance of the Annual Meeting even if you plan on attending. If your common shares are held by a bank, or broker or any other nominee, you must follow the voting instructions provided to you by the bank, broker, or nominee. Although most

banks and brokers offer voting by mail, telephone, and the Internet,internet, availability and specific procedures will depend on their voting arrangements.

Unless revoked, common shares represented by a properly signed and returned proxy card (or other valid form of proxy), or as instructed via telephone or Internet,internet, received in time for voting will be voted as instructed. If your proxy card is signed and returned with no instructions given, the persons designated as proxy holders on the proxy card will vote as follows:

FOR the election of each director nominee named herein (proposal 1);

FOR the amendment to the Company’s Amended Code of Regulations and Amended Articles of Incorporation to require a majority vote, in uncontested elections, for director nominees to be elected (proposal 2);

FOR the amendment to the Company’s Amended Code of Regulations to reduce the threshold for shareholder removal of a director from a two-thirds supermajority to a simple majority (proposal 3);

FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers (proposal 2)4); and

FOR the ratification of the appointment of Grant Thornton, LLP as our independent registered public accounting firm (proposal 3)5).

The Company knows of no other matters scheduled to come before the Annual Meeting. If any other business is properly brought before the Annual Meeting, your proxy gives discretionary authority to the proxy holders with respect to such business, and the proxy holders intend to vote the proxy as recommended by our board of directors with regard to any such business, or, if no such recommendation is given, the proxy holders will vote in their own discretion.

Revocability of Proxies

You may revoke or change your vote at any time before the final vote on the matter is taken at the Annual Meeting by submitting to our Secretary a notice of revocation or by timely delivery of a valid, later-dated, duly executed proxy by mail, telephone, or Internet.internet. You may also revoke or change your vote by attending the Annual Meeting and voting in person. If your shares are held by a bank, broker, or other nominee, you must contact the bank, broker, or nominee and follow their instructions for revoking or changing your vote.

Vote Required, Abstentions, and Broker Non-Votes

If a quorum is present at the Annual Meeting, the nominees named herein for election as directors in proposal 1 will be elected if they receive the greatest number of votes cast at the Annual Meeting present in person or represented by proxy and entitled to vote. Abstentions will have no effect on the election of directors.

For proposal 2 (amendment to the Company’s Amended Code Regulations and Amended Articles of Incorporation to require a majority vote, in uncontested elections, for director nominees to be elected) and proposal 3 (amendment to the Company’s Amended Code Regulations to reduce the threshold for shareholders to remove of a director from a two-thirds supermajority to a simple majority), if a quorum is present at the Annual Meeting, the affirmative vote of two-thirds of the voting power of the Company’s outstanding common stock will be required to approve each proposal. Abstentions and broker non-votes will have the same effect as votes against these proposals, although they will be considered present for the purpose of determining a quorum.

For proposal 4 (advisory vote on named executive officer compensation) and proposal 35 (ratification of independent registered public accounting firm), if a quorum is present, the affirmative vote of the holders of shares representing a majority of the common shares present in person or represented by proxy and entitled to vote will be required to approve each proposal. The effect of an abstention is the same as a vote against each proposal. If you hold your shares in street name and do not give your broker or nominee instruction as to how to vote your shares with respect to proposals 24 and 3,5, your broker or nominee will not have discretionary authority to vote your shares on proposals 24 and 3.5. These broker non-votes will have no effect on proposals 24 and 3.5.

Cumulative Voting

Each shareholder has the right to vote cumulatively in the election of directors if the shareholder gives written notice to our Chief Executive Officer or Secretary not less than 48 hours before the Annual Meeting commences to our Chief Executive Officer or Secretary that he, she, or itthe shareholder wants its voting for the election of directors to be cumulative. In such event, the shareholder giving notice, or a representative of such shareholder, the Chairman, or the Secretary, will make an announcement aboutannounce such notice at the start of the Annual Meeting. Cumulative voting means that the shareholder may cumulate his, her, or its voting power for the election of directors by distributing a number of votes, determined by multiplying the number of directors to be elected at the Annual Meeting times the number of such shareholder’s shares. The shareholder may distribute all of the votes to one individual director nominee or distribute the votes among two or more director nominees, as the shareholder chooses. In the event of cumulative voting, unless contrary instructions are received, the persons named in the enclosed proxy will vote the shares represented by valid proxies on a cumulative basis for

the election of the nominees named herein, allocating the votes among the nominees in accordance with their discretion.

Proxy Solicitation

The cost of solicitation of proxies, including the cost of preparing, assembling, and mailing the Notice, Proxy Statement, and proxy card, will be borne by us.the Company. In addition to solicitation by mail, arrangements may be made with brokerage houses and other custodians, nominees, and fiduciaries to send proxy materials to their principals, and we may reimburse them for their expenses in so doing. Our officers, directors, and employees may, without additional compensation, personally or by other appropriate means request the return of proxies.

Attending the Annual Meeting

All holders of our common shares at the close of business on the Record Date, or their duly appointed proxies, are authorized to attend the Annual Meeting. Cameras, recording devices, and other electronic devices will not be permitted at the Annual Meeting. If you hold your common shares through a bank, broker, or other nominee, you will need to bring a copy of the brokerage statement reflecting your share ownership as of the Record Date, or a legal proxy from your bank or broker, to attend the meeting.

Voting Results

Preliminary voting results will be announced at the Annual Meeting. Within four business days following the Annual Meeting, final results, or preliminary results if final results are unknown, will be announced on a Form 8-K filed with the Securities and Exchange Commission (“SEC”). If preliminary results are announced, final results will be announced on a Form 8-K filed with the SEC within four business days after the final results are known.

Company Information

Our 20172019 Annual Report is being mailed with this Proxy Statement. These documents also are available electronically on our website at www.agilysys.com, under Investor Relations. Our 20172019 Annual Report is not incorporated into this Proxy Statement and is not to be considered proxy solicitation material. If you wish to have additional copies of our 20172019 Annual Report, we will mail copies to you without charge. Requests may be sent to our corporate services office at: Agilysys, Inc., Attn: Investor Relations, 1000 Windward Concourse, Suite 250, Alpharetta, Georgia 30005, or you may request copies through our website, under Investor Relations. These documents have been filed with the SEC and also may be accessed from the SEC’s website at www.sec.gov.www.sec.gov. If you have any questions about the Annual Meeting or these proxy materials, please contact Investor Relations by telephone at 770-810-7948,770-810-7941, or by email at investorrelations@agilysys.com, or through our website under Investor Relations.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Corporate Governance Guidelines (the “Guidelines”) adopted by our board of directors are intended to provide

a sound framework to assist the board of directors in fulfilling its responsibilities to shareholders. Under the Guidelines, the board of directors exercises its role in overseeing the Company by electing qualified and competent officers and by monitoring the performance of the Company. The Guidelines state that the board of directors and its committees exercise oversight of executive officer compensation and director compensation, succession planning, director nominations, corporate governance, financial accounting and reporting, internal controls, strategic and operational issues, and compliance with laws and regulations. The Guidelines also state the board of directors’ policy regarding eligibility for the board of directors, including director independence and qualifications for director candidates, events that require resignation from the board of directors, service on other public company boards of directors, and stock ownership guidelines. The Nominating and Corporate Governance Committee annually reviews the Guidelines and makes recommendations for changes to the board of directors. The Guidelines are available on our website at www.agilysys.com, under Investor Relations.

Code of Business Conduct

The Code of Business Conduct adopted by our board of directors applies to all directors, officers, and employees of the Company, as well as certain third parties, and incorporates additional ethics standards applicable to our Chief Executive Officer, Chief Financial Officer, and other senior financial officers of the Company, and any person performing a similar function. The Code of Business Conduct is reviewed annually by the Audit Committee, and recommendations for change are submitted to the board of directors for approval. The Code of Business Conduct is available on our website at www.agilysys.com, under Investor Relations. The Company has in place a reporting hotline and website available for use by all employees and third parties, as described in the Code of Business Conduct. Any employee or third-party can anonymously report potential violations of the Code of Business Conduct through the hotline or website, both of which isare managed by an independent third party. Reported violations are promptly reported to and investigated by the Company. Reported violations are addressed by the Company and, if related to accounting, internal accounting controls, or auditing matters, the Audit Committee. In addition, we intend to post on our website all disclosures that are required by law or NASDAQ listing standards concerning any amendments to, or waivers from, any provision of the Code of Business Conduct.

Director Independence

NASDAQ listing standards provide that at least a majority of the members of the board of directors must be independent, meaning free of any material relationship with the Company, other than his or her relationship as a director. The Guidelines state that the board of directors should consist of a substantial majority of independent directors. A director is not independent if he or she fails to satisfy the standards for director independence under NASDAQ listing standards, the rules of the SEC, and any other applicable laws, rules, and regulations. During the board of directors’ annual review of director independence, the board of directors considers transactions, relationships, and arrangements, if any, between each director or a director’s immediate family members and the Company or its management. In June 2017,May 2019, the board of directors performed its annual director independence review and, as a result, of such review determined that each of Donald Colvin, Dana Jones, Jerry Jones, Michael A. Kaufman, Melvin Keating, Keith M. Kolerus, and John Mutch qualify as independent directors. Ramesh Srinivasan is not independent because of his service as President and CEO of the Company.

Director Attendance

The board of directors held six meetings during fiscal year 2017,2019, and no director attended less than 75% of the aggregate of the total number of board of director meetings and meetings held by committees of the board of directors on which hethe director served. Independent directors meet regularly in executive session at board of director and committee meetings, and executive sessions are chaired by the chairman of the board or by the appropriate committee chairman. It is the board of directors’ policy that all of its members attend the Annual Meeting of Shareholders absent exceptional cause. All of the Directors attended the 2016 2018 Annual Meeting.Meeting, other than Dana Jones, who was not then a Director.

Shareholder Communication with Directors

Shareholders and others who wish to communicate with the board of directors as a whole, or with any individual director, may do so by sending a written communication to such director(s) in care of our Secretary at our Alpharetta, Georgia office address, and our Secretary will forward the communication to the specified director(s).

Committees of the Board

During fiscal year 2017,2019, the board of directors had fourthree standing committees: Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, and Strategic Review Committee. The Strategic Review Committee was disbanded in February 2017. Mr. Srinivasan is not a member of any committee. At the end of the fiscal year, and as of July 7, 2017, the members and chairman of each committee were as follows:

|

| | | | |

Director |

Audit |

Compensation | Nominating and Corporate Governance |

Strategic

Review

|

| Donald Colvin* | Chairman | | | |

| Jerry Jones | X | | X | X |

| Michael A. Kaufman | | X | Chairman | Chairman |

| Melvin Keating | | Chairman | X | X |

| Keith M. Kolerus | X | | X | X | |

| John Mutch* | X | X | | X |

*Qualifies as an Audit Committee Financial Expert.

As of June 25, 2019, the committee membership set forth above remained the same. Dana Jones, who joined the board of directors after the end of fiscal year 2019 and, therefore, was not a member of a board committee at the end of the fiscal year, was as of June 25, 2019 a member of the Audit and Nominating and Corporate Governance Committees.

Committee Charters. The board of directors has adopted a charter for each committee, other than the Strategic Review Committee, and each committee with a charter is responsible for the annual review of its respective charter. Charters for each committee are available on our website at www.agilysys.com, under Investor Relations.

Audit Committee. The Audit Committee held nineeight meetings during fiscal year 2017.2019. The Audit Committee reviews, with our independent registered public accounting firm, the proposed scope of our annual audits and audit results, as well as interim reviews of quarterly reports; reviews the adequacy of internal financial controls; reviews internal audit functions; is directly responsible for the appointment, determination of compensation, retention, and general oversight of our independent registered public accounting firm; reviews related person transactions; oversees the Company’s implementation of its Code of Business Conduct; and reviews any concerns identified by either the internal or external auditors. The board of directors determined that all Audit Committee members are financially literate and independent under NASDAQ listing standards for audit committee members. The board of directors also determined that Messrs. Colvin and Mutch each qualify as an “audit committee financial expert” under SEC rules.

Compensation Committee. The Compensation Committee held four meetings during fiscal year 2017.2019. The purpose of the Compensation Committee is to enhance shareholder value by ensuring that pay available to the board of directors, Chief Executive Officer, and other executive officers enables us to attract and retain high-quality leadership and is consistent with our executive pay philosophy. As part of its responsibility, the Compensation Committee oversees our pay plans and policies; annually reviews and determines all pay, including base salary, annual cash incentive, long-term equity incentive, and retirement and perquisite plans; administers our incentive programs, including establishing performance goals, determining the extent to which performance goals are achieved, and determining awards; administers our equity pay plans, including making grants to our executive officers; and regularly evaluates the effectiveness of the overall executive pay program and evaluates our incentive plans to determine if the plans’ measures or goals encourage inappropriate risk-taking by our employees.executives. A more complete description of the Compensation Committee’s functions is found in the Compensation Committee Charter.

The board of directors determined that all Compensation Committee members are independent under NASDAQ listing standards for compensation committee members.

Our Legal and Human Resources Departments support the Compensation Committee in its work and, in some cases, as a result of delegation of authority by the Compensation Committee, fulfill various functions in administering our pay programs. In addition, the Compensation Committee has the authority to engage the services of outside consultants and advisers to assist it. The Committee engages compensation consultants to perform current market assessments when it believes that such an assessment would inform its decision making with respect to executive compensation. The Compensation Committee did not engage a compensation consultant to advise it in connection with setting compensation for the Named Executive Officers in fiscal year 2017.2019.

Our Chief Executive Officer, Chief Financial Officer and General Counsel attend Compensation Committee meetings when executive compensation, Company performance, and individual performance are discussed and evaluated by Compensation Committee members, and they provide their thoughts and recommendations on executive pay issues during these meetings and provide updates on financial performance, industry status, and other factors that may impact executive compensation. Decisions regarding the Chief Executive Officer’s compensation were based solely on the Compensation Committee’s deliberations, while compensation decisions regarding other

executive officers took into consideration recommendations from the Chief Executive Officer. Only Compensation Committee members make decisions on executive officer compensation and approve all outcomes.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee (“Nominating Committee”) held threefour meetings during fiscal year 2017.2019. The board of directors determined that all Nominating Committee members are independent under NASDAQ listing standards. The Nominating Committee assists the board of directors in finding and nominating qualified people for election to the board; reviewing shareholder-recommended nominees; assessing and evaluating the board of directors’ effectiveness; and establishing, implementing, and overseeing our governance programs and policies. The Nominating Committee is responsible for reviewing the qualifications of, and recommending to the board of directors, individuals to be nominated for membership on the board of directors. The board of directors has adopted Guidelines for Qualifications and Nomination of Director Candidates (“Nominating Guidelines”), and the Nominating Committee considers nominees using the criteria set forth in the Nominating Guidelines. At a minimum, a director nominee must:

Be of proven integrity with a record of substantial achievement;

Have demonstrated ability and sound business judgment based on broad experience;

Be able and willing to devote the required amount of time to the Company’s affairs, including attendance at board of director and committee meetings;

Be analytical and constructive in the objective appraisal of management’s plans and programs;

Be committed to maximizing shareholder value and building a sound company, long-term;

Be able to develop a professional working relationship with other directors and contribute to the board or directors’ working relationship with senior management of the Company;

Be able to exercise independent and objective judgment and be free of any conflicts of interest with the Company; and

Be able to maintain the highest level of confidentiality.

The Nominating Committee considers the foregoing factors, among others, in identifying nominees; however, there is no policy requiring the Nominating Committee to consider the impact of any one factor by itself. The Nominating Committee also will consider the board of directors’ current and anticipated needs in terms of number, diversity, specific qualities, expertise, skills, experience, and background. In addition, the Corporate Governance Guidelines state that the board of directors should have a balanced membership, with diverse representation of relevant areas of experience, expertise, and backgrounds. The Nominating Committee seeks nominees that collectively will build a capable, responsive, and effective board of directors, prepared to address strategic, oversight, and governance challenges. The Nominating Committee believes that the backgrounds and qualifications of the directors as a group should provide a significant mix of experience, knowledge, and abilities that will enable the board of directors to

fulfill its responsibilities.

The Nominating Committee will consider shareholder-recommended nominees for membership on the board of directors. For a shareholder to properly nominate a candidate for election as a director at a meeting of the shareholders, the shareholder must be a shareholder of record at the time the notice of the nomination is given and at the time of the meeting, be entitled to vote at the meeting in the election of directors, and have given timely written notice of the nomination to the Secretary. To be timely, notice must be received by the Secretary, in the case of an annual meeting, not less than 90 days nor more than 120 days prior to the anniversary of the previous year’s annual meeting; provided, however, that if the date of the annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after the anniversary of the preceding year’s annual meeting, notice must be delivered not later

than the close of business on the later of the 90th day prior to such annual meeting or the 10th calendar day following

the day on which public disclosure of the date of such annual meeting is first made. In the case of a special meeting, timely notice must be received by the Secretary not later than the close of business on the 10th day after the date of such meeting is first publicly disclosed. A shareholder’s notice must set forth, as to each candidate:

Name, age, business address, and residence address of the candidate;

Principal occupation or employment of the candidate;

Class and number of shares that are owned of record or beneficially by the candidate;

Information about the candidate required to be disclosed in a proxy statement complying with the rules and regulations of the SEC;

Written consent of the candidate to serve as a director if elected and a representation that the candidate does not and will not have any undisclosed voting arrangements with respect to his actions as a director, will comply with the Company’s Amended Code of Regulations and all other publicly disclosed corporate governance, conflict of interest, confidentiality, and share ownership and trading policies and Company guidelines;

Name and address of the shareholder making such nomination and of the beneficial owner, if any, on whose behalf the nomination is made;

Class and number of shares that are owned of record or beneficially by the shareholder and by any such beneficial owner as of the date of the notice;

Representation that the shareholder or any such beneficial owner is a holder of record or beneficially of the shares entitled to vote at the meeting and intends to remain so through the date of the meeting;

Description of any agreement, arrangement, or understanding between or among the shareholder and any such beneficial owner and any other persons (including their names) with respect to such nomination;

Description of any agreement, arrangement, or understanding in effect as of the date of the shareholder’s notice pursuant to which the shareholder, any such beneficial owner, or any other person directly or indirectly has other economic interests in the shares of the Company;

Representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; and

Representation whether the shareholder intends to deliver a proxy statement and/or form of proxy to holders of outstanding common shares and/or otherwise to solicit proxies in support of the nomination.

The Nominating Committee may request additional information from such nominee to assist in its evaluation. The Nominating Committee will evaluate any shareholder-recommended nominees in the same way it evaluates nominees recommended by other sources, as described above.

Strategic Review Committee. The Strategic Review Committee met only informally during fiscal year 2017. The purpose of the Strategic Review Committee was to review and evaluate strategic alternatives to the Company’s current strategy and to recommend to the board of directors what action, if any, should be taken by the Company. For fiscal year 2017, the members of the Strategic Review Committee took a leading role in the search for a successor chief executive officer, including conducting interviews, discussing candidates and reporting to the board of directors their findings and opinions. Following the selection of the new chief executive officer, the board of directors determined that the Strategic Review Committee was no longer necessary, and it was disbanded.

Board Leadership

The board of directors determined that having an independent director serve as chairman of the board is in the best interest of shareholders at this time. The structure ensures a greater role for our independent directors in the

oversight of the Company and the active participation in setting agendas and establishing priorities and procedures for the board of directors. Pursuant to the board of directors’ Corporate Governance Guidelines, it is our policy that the positions of chairman of the board and chief executive officer be held by different individuals, except as otherwise determined by the board of directors. Mr. Kaufman has served as Chairman of the Board since 2015.

The board hashad previously established the role of vice-chairman of the board to assist the chairman of the board in the performance of his duties, as directed by the chairman from time to time. Mr. Kolerus has served as vice-chairman of the board since 2015.

from 2015 to 2019. Mr. Kolerus announced his retirement from the board effective as of the end of June 2019, and the board decided not to continue the role of vice chairman following his retirement.

Risk Oversight

Management is responsible for the day-to-day management of risks facing the Company, while theCompany. The board of directors, as a whole and through its committees, particularly the Audit Committee, is actively involved in the oversight of such risks. The board of directors’ role in risk oversight includes regular reports at board of director and Audit Committee meetings from members of senior management on areas of material risk to the Company, including strategic, financial, operational, and legal and regulatory compliance risks. Management regularly identifies and updates, among other items, the population of possible risks for the Company, assigns risk ratings, prioritizes the risks, assesses likelihood of risk occurrence, develops risk mitigation plans for prioritized risks, and assigns roles and responsibilities to implement mitigation plans. Risks are ranked by evaluating each risk’s likelihood of occurrence and magnitude. The board of directors’ Compensation Committee, in consultation with management, evaluates our incentive plans to determine if the plans’ measures or goals encourage inappropriate risk-taking by our employees. As part of its evaluation, the Compensation Committee determined that the performance measures and goals were tied to our business, financial, and strategic objectives. As such, the incentive plans are believed not to encourage risk-taking outside of the range of risks contemplated by the Company’s business plan.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee during fiscal year 20172019 (Messrs. Jones, Kaufman, Keating, Kolerus, and Mutch) is or has been an officer or employee of the Company or has had any relationship with the Company required to be disclosed as a related person transactionstransaction, and none of our executive officers served on the compensation committee (or other committee serving an equivalent function) or board of any company that employed any member of our Compensation Committee or our board of directors during fiscal year 2017.

2019.

DIRECTOR COMPENSATION

During fiscal year 2017,2019, compensation for non-employee directors consisted of the following:

$25,00030,000 annual cash retainer for each non-employee director;

$35,000 annual cash retainer for the chairman of the board;

$15,000 annual cash retainer for the chairman of the Audit Committee (increased from $10,000 beginning January 1, 2017);Committee;

$12,500 annual cash retainer for the chairman of the Compensation Committee;

$7,500 annual cash retainer for the chairmenchairman of each of the Compensation and Nominating & Corporate Governance Committees;Committee;

$10,000 annual cash retainer for each member of the Audit, Nominating & Corporate Governance, and Compensation Committees, including each chairman;

$10,000 annual cash retainer to each member of the Strategic Review Committee, including the chairman;

$5,000 monthly cash retainer for each member of the Strategic Review Committee, including the chairman;

An award of restricted shares to each non-employee director valued at $70,000$75,000 on the grant date.

We also reimburse our directors for reasonable out-of-pocket expenses in connection withincurred for attendance at board of directors and committee meetings.

The fiscal year 20172019 equity award for each director consisted of 6,0715,274 restricted shares, based on a $11.53$14.22 grant date price, and was granted under the 2016 Stock Incentive Plan. The restricted shares vested on March 31, 2017,2019, and provided for pro-rata vesting upon retirement prior to March 31, 2017.2019. The grant was made in June 2017on May 31, 2018, to the then current non-employee directors; however, Mr. Kaufman declined the award given the significant ownership in the Company by his firm, MAK Capital.

Our directors are subject to share ownership guidelines that require ownership of either (i) three times the director’s .respectiverespective annual cash retainer within two years of service and six times the director’s respective annual cash retainer within four years of service; or (ii) 15,000 shares within the first two years following the director’s election to the board of directors and 45,000 shares within four years of election. We pay no additional fees for board of director or committee meeting attendance.

Director Compensation for Fiscal Year 20172019

| | Director | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Total ($) | Fees Earned or Paid in Cash ($)(2) | Stock Awards ($)(3) | Total ($) |

| Donald Colvin | 45,000 | | 65,992 | | 110,992 | | 55,000 |

| | 74,996 |

| | 129,996 |

| |

| Dana Jones (4) | | — |

| | — |

| | — |

| |

| Jerry Jones | 45,000 | | 65,992 | | 110,992 | | 50,000 |

| | 74,996 |

| | 124,996 |

| |

| Michael A. Kaufman | 132,500 | | 132,500 | | 92,500 |

| | — |

| | 92,500 |

| |

| Keith M. Kolerus | 45,000 | | 65,992 | | 110,992 | | 50,000 |

| | 74,996 |

| | 124,996 |

| |

| Melvin Keating | 97,500 | | 65,992 | | 163,492 | | 62,500 |

| | 74,996 |

| | 137,496 |

| |

| John Mutch | 90,000 | | 65,992 | | 155,992 | | 50,000 |

| | 74,996 |

| | 124,996 |

| |

(1)Our CEO, Ramesh Srinivasan, is also a member of the board of directors, but he receives

no direct compensation for such service.

(2) Fees are paid quarterly.

| |

(2)(3) | Amounts in this column represent the grant date fair value of the restricted shares computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”)(ASC) Topic 718. |

| |

| (4) | Dana Jones joined the board of directors after the end of fiscal year 2019 and, therefore, |

received no compensation for fiscal year 2019.

PROPOSAL 1

ELECTION OF DIRECTORS

General

Our board of directors currently consists of seven members whose term expires at this Annual Meeting. In each case, subject to their earlier death, resignation, removal or retirement, the directors remain in office until their respective successors are duly elected and qualified, notwithstanding the expiration of the otherwise applicable term.

Nominees for Director

Upon the recommendation of the Nominating and Corporate Governance Committee, comprised of independent directors, the board of directors has nominated each of Donald Colvin, Dana Jones, Jerry Jones, Michael A. Kaufman, Melvin Keating, Keith M. Kolerus, John Mutch and Ramesh Srinivasan for election to the board of directors for a term of

one year, to serve until the annual meeting of shareholders in 20182020 and until their successors have been duly elected and qualified, subject to their earlier death, resignation, retirement or removal. Information concerning the nominees for election at this Annual Meeting is set forth below.

Unless authority to vote for any of these nominees is withheld, the shares represented by a validly executed proxy will be voted “FOR” the election of each of Ms. Jones and Messrs. Colvin, Jones, Kaufman, Keating, Kolerus, Mutch and Srinivasan for a one-year term. Each nominee has indicated his or her willingness to serve as a director, if elected.

A biography for each director nominee follows and, if applicable, arrangements under which a director was appointed to the board of directors or information regarding any involvement in certain legal or administrative

proceedings is provided. Additional information about the experiences, qualifications, attributes, or skills of each director and director nominee in support of his or her service on the board of directors is also provided.

DIRECTOR NOMINEES

|

| | |

| Donald Colvin | Age 6466 | Director since 2015 |

Mr. Colvin is a director of Viavi Solutions Inc., a global provider of network test, monitoring and assurance solutions, and was previously a director of Applied Micro Circuits Corp. Mr. Colvin was the Interim Chief Financial Officer of Isola Group Ltd. from June 2015 to July 2016.2015. Mr. Colvin previously served as Chief Financial Officer of Caesars Entertainment Corporation from November 2012 to January 2015 and before that was Executive Vice President and CFOChief Financial Officer of ON Semiconductor Corp. from April 2003 to October 2012. Prior to joining ON Semiconductor, Mr. Colvinhe held a number of financial leadership positions, including Vice President of Finance and CFOChief Financial Officer of Atmel Corporation, CFOChief Financial Officer of European Silicon Structures as well as several financial roles at Motorola Inc.

Mr. Colvin is a director of Viavi Solutions Inc. (Nasdaq: VIAV), a director and Chairman of the Audit Committee of Isola Group, a director of UTAC (a private Singapore company) and a member of the Advisory Board for Conexant. Mr. Colvin holds aearned his B.A. in economicsEconomics, with honors, and an M.B.A. from the University of Strathclyde in Scotland. Mr. Colvin’s qualifications and extensive experience include financial management, capitalstructure, financial strategy, significant public company leadership and board experience, and recent experience in the hospitality industry which the Company serves.

|

| | |

| Dana Jones | Age 44 | Director since 2019 |

Dana Jones is the Chief Executive Officer of Sparta Systems, the market leader in digital enterprise quality management software for the life sciences space. Prior to joining Sparta, Dana served as Chief Executive Officer of Active Network (Nasdaq: ACTV), the leader in activity and event management software. Under her leadership, the company grew rapidly, leading to the sale of the Sports and Communities divisions to Global Payments, Inc. (NYSE: GPN) for $1.2 billion. Before joining Active Network, Ms. Jones was Chief Marketing Officer and Senior Vice President of Products for Sabre Airline Solutions, a global provider of software to the airline industry. Prior to Sabre, Ms. Jones co-founded Noesis Energy, and served as Executive Vice President of Product, Sales, Marketing, and Operations. Ms. Jones has held Executive and General Management positions for early stage and global publicly traded enterprise software companies over the last 20 years, including the Reynolds Company and Vignette (Nasdaq: VIGN). She started her career as a management consultant with A.T. Kearney.

Ms. Jones graduated Summa Cum Laude and holds a BSE in industrial and operations engineering from the University of Michigan. Ms. Jones is an accomplished software executive with decades of experience leading and growing cloud-based global enterprise software businesses.

|

| | |

| Jerry Jones | Age 6163 | Director since 2012 |

Mr. Jones is the Executive Vice President, Chief Ethics and Legal Officer Executive Vice-President of Acxiom Corporation,LiveRamp Holdings, Inc. (NYSE: RAMP), a marketing technology and servicessoftware-as-a-service (SaaS) company since 1999.that provides the identity platform for powering exceptional experiences. His responsibilities include oversight of its legal, privacy and security teams and various strategic initiatives, including the strategy and execution of mergers and alliances. Prior to LiveRamp, Mr. Jones was the Chief Ethics and Legal Officer at Acxiom since 1999, where he oversaw all legal and data ethics matters. Prior to joining Acxiom, Mr. Jones was a partner with the Rose Law Firm in Little Rock, Arkansas, where he specialized in problem solving and business litigation for 19 years, representing a broad range of business interests. Previously he was a directorDirector of Entrust, Inc. He(Nasdaq: ENTU).

Mr. Jones is a 1980 graduate of the University of Arkansas School of Law and holds a bachelor’s degree in public administration from the University of Arkansas. As the Chief Ethics and Legal Officer of a technologySaaS company, Mr. Jones has extensive experience with legal, privacy, and security matters. He has also led the strategy and execution of mergers and alliances and international expansion efforts.

|

| | |

| Michael A. Kaufman | Age 4547 | Director since 2014 |

Mr. Kaufman is the PresidentChief Executive Officer of MAK Capital, a financial investment advisory firm based in New York, NY, which he founded in 2002. In addition, Mr. Kaufman has served as a director of Skyline Champion Corporation (NYSE: SKY) since 2018.

Mr. Kaufman holds a B.A. degree in Economics from the University of Chicago, where he also received his M.B.A. He also earned a law degree from Yale University. As PresidentChief Executive Officer of MAK Capital, a significant shareholder of the Company’s largest shareholder,Company, Mr. Kaufman is uniquelyespecially qualified to represent the interests of the Company’s shareholders as a director and chairman of the board. Additionally, Mr. Kaufman’s qualifications and experience include capital markets, investment strategy and financial management.

|

| | |

| Melvin Keating | Age 7072 | Director since 2015 |

DirectorMr. Keating has been a consultant, providing investment advice and other services to public companies and private equity firms, since 2008. Mr. Keating also serves as a director of Vitamin Shoppe, Inc., a retailer of nutritional supplements (since April 2018), Harte Hanks, Inc., a global marketing services firm (since July 2017), and MagnaChip Semiconductor Corp, (NYSE: MX) sincea designer and manufacturer of analog and mixed-signal semiconductor platform solutions (since August 2016. Mr. Keating2016). Previously he was a Directordirector of Red Lion Hotels Corporation (NYSE: RLH) from July 2010 until June 2017, andserving as Chairman of the Board from May 2013 to 2015. Since November 2008,During the past five years, Mr. Keating has beenalso served on the boards of directors of the following public companies: API Technologies Corp. (2011 - 2016); Crown Crafts Inc. (2010 -2013), ModSys International Ltd. (formerly BluePhoenix Solutions Ltd., 2010 - 2016), and SPS Commerce, Inc., a consultantprovider of cloud-based supply chain management solutions (from March 2018 to several private equity firms and public companies, representing industries where he previously worked. Prior to that, he was President and CEO of Alliance Semiconductor from 2005 to 2008. May 2019).

Mr. Keating holds a B.A. from Rutgers University as well as both an M.S. in Accounting and an M.B.A. in Finance from The Wharton School of the University of Pennsylvania. Mr. Keating has substantial experience leading public companies in the technology and hospitality industries and is qualified in global operations, financial management and strategy and capital markets.

|

| | |

Keith M. Kolerus | Age 71 | Director since 1998 |

Chairman of the Board of Directors of the Company from 2008 to 2015. Mr. Kolerus also served as Chairman of the Board of Directors of Minco Technology Labs, a manufacturer of high reliability semiconductors, from 2010 to 2015, ACI Electronics, LLC, from 2004 to 2008, and National Semiconductor Japan Ltd., from 1995 to 1998. He holds a bachelor of engineering degree from Vanderbilt University and an M.B.A. from Loyola University, Chicago. Mr. Kolerus has extensive experience in engineering, global operations, private and public companies, software and hardware technology companies, government contracting, capital markets, financial management, and the technology industry. Mr. Kolerus’ prior extensive experience leading boards of directors also qualify him to serve on our board of directors.

|

| | |

| John Mutch | Age 6163 | Director since 2009 |

Founder andMr. Mutch is managing partner of MV Advisors LLC. Mr. Mutch founded MV Advisors in January of 2006 asLLC, a strategic block investment firm which provides focused investmentfounded by Mr. Mutch in January of 2006. He is chairman of the board of Aviat Networks, a global supplier of microwave networking solutions (since 2015), and operational guidance to both privatea director of Maxell Technologies, an energy storage and public companies. MV Advisors’ current portfolio includes companies in the technology, active lifestyle and sports segments valued in excess of $100M.power delivery solutions company (since 2017). Mr. Mutch’s career as an operating executive in the technology sector includes servingMutch served as Chairman and Chief Executive Officer of BeyondTrust Software, a privately held security software company focused on privilege identity management solutions, from 2008 to 2013,2013. He previously served as a Directordirector of YuMe, Inc., a data analysis platform for television advertising (from 2017 to

2018), and Chief Executive Officer of Peregrine Systems (Nasdaq: PRGS) from 2003 to 2005, and as a Director and Chief Executive Officer on HNC Software (Nasdaq: HNCS) from 1999 to 2002. Previously he spent eight years in a variety of executive sales and marketing positions at Microsoft Corporation. Mr. Mutch current serves on the board of directors of Steel Excel, Inc. (Nasdaq: SXCL)an oilfield service company (from 2008 to 2016).

Mr. Mutch holds a B.S. Inin Economics from Cornell University and an M.B.A. from the University of Chicago. As a former chief executive officer and board member of technology companies, Mr. Mutch has extensive experience in the technology industry, restructuring, financial management and strategy, capital markets, sales management, and marketing.

|

| | |

| Ramesh Srinivasan | Age 5759 | Director since 2017 |

Mr. Srinivasan has been President and Chief Executive Officer of the Company since January 3, 2017. He also serves on the board of advisors for Symbotic, a supply chain robotics and solutions company. He previously served as Chief Executive OfficerCEO of Ooyala, a Silicon Valley based provider of a suite of technology offerings in the online video space, from January 2016 to November 2016. From March 2015 to November 2015, he was President and Chief Executive OfficerCEO of Innotrac Corporation,Corp., an ecommerce fulfillment provider which merged with eBay Enterprise to form Radial Inc in 2015. Prior to that, he wasMr. Srinivasan served as President and Chief Executive OfficerCEO of Bally Technologies Inc. (NYSE: BYI) from December 2012 untilto May 2014, and President and COO from April 2011 untilto December 2014 he was President and Chief Operating Officer of Bally Technologies Inc., where2012; he started as Executive Vice President of Bally Systems in March 2005. Mr. Srinivasan was with Manhattan Associates from 1998 to 2005, where his last position was Executive Vice-President of Warehouse Management Systems.

Mr. Srinivasan holds a Post-Graduate Diploma in Management (MBA) from the Indian Institute of Management, Bangalore, India, and a degree in Engineering from the Indian Institute of Technology (Banaras Hindu University), Varanasi, India. Mr. Srinivasan has close to 3nearly three decades of hands-on enterprise software development, execution and senior technology management leadership and strategy expertise and accomplishments, including experience and expertise in driving performance at high growth technology companies and helping them scale their business profitably.

Vote Required

If a quorum is present at the annual meeting, theThe nominees for election as directors will be elected if they receive the greatest number of votes cast at the Annual Meeting present in person or represented by proxy and entitled to vote. Abstentions and broker non-votes will have no effect on the election of directors.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES. PROXY CARDS RECEIVED BY THE COMPANY WILL BE VOTED “FOR” THE ELECTION OF EACH OF THE NOMINEES UNLESS THE SHAREHOLDER SPECIFIES OTHERWISE ON THE PROXY CARD.

PROPOSAL 2

AMENDMENT TO THE COMPANY’S AMENDED CODE OF REGULATIONS AND

AMENDED ARTICLES OF INCORPORATION TO IMPLEMENT MAJORITY VOTING

IN UNCONTESTED DIRECTOR ELECTIONS

Our board of directors recommends that shareholders approve an amendment to our Amended Code of Regulations (the “Code”) and Amended Articles of Incorporation (the “Articles”), to require a majority vote, in uncontested elections, for director nominees to be elected (the “Amendments”). The board has concluded that the adoption of a majority voting standard in uncontested elections of directors will give shareholders a greater voice in director elections by giving effect to votes “against” nominees, and by requiring a nominee to receive an affirmative majority of votes cast to obtain or retain a seat on the board. The adoption of this standard in uncontested elections is

intended to reinforce the board’s accountability to the interests of shareholders and to reflect emerging corporate governance best practices.

Under the current plurality voting standard, nominees receiving the greatest number of votes “FOR” election are elected to the board, regardless of how many votes are cast. Under majority voting, each vote is required to be counted “FOR” or “AGAINST” a nominee’s election. To be elected to the board, the votes cast “FOR” a nominee’s election must exceed the votes cast “AGAINST.” Shareholders would also be able to “abstain” from voting, but abstentions and broker non-votes would not be counted in determining whether the affirmative majority vote has been obtained. If approved, the majority voting standard would only apply in uncontested elections of directors. In contested elections, plurality voting would remain the voting standard since it is the only standard that ensures all vacant board seats would be filled.

Ohio Revised Code Section 1701.55(b) requires that an Ohio company seeking to provide for majority voting do so in its articles of incorporation, rather than its code of regulations. The board is therefore asking shareholders to approve amendments to the Articles to implement majority voting and amendments to the Code to reference the majority voting standard in the Articles. Since these amendments to the Articles and Code are inextricably intertwined, by voting “FOR” this proposal, shareholders will be authorizing the board to implement both. The text of the proposed Amendments is set forth in Annex A to this Proxy Statement.

If approved by shareholders, the Amendments will become effective upon the filing of an amendment to the Amended Articles of Incorporation with the Ohio Secretary of State. The Company would make this filing promptly after shareholder approval at the 2019 Annual Meeting. The new majority voting standard would then be effective for an uncontested election of directors at the Company’s 2020 annual meeting of shareholders.

Currently, under Ohio Revised Code Section 1701.51, an incumbent director who is not re-elected remains in office until the director’s successor is elected and qualified, or until his or her earlier resignation or removal. Therefore, if this proposal is approved by the shareholders, the board will also amend its Corporate Governance Guidelines to provide a director resignation policy if a nominee who is currently a director of the Company is not re-elected to the board by an affirmative majority of the votes cast at an uncontested election. The resignation policy would require the director to tender his or her resignation to the chair of the Nominating and Corporate Governance Committee, with the board determining within 90 days whether to accept the resignation. Annex A to this proxy statement also includes the director resignation policy as it would be adopted into the Company’s Corporate Governance Guidelines by the board.

Vote Required

Adoption of the amendments to the Code and Articles requires the affirmative vote of two-thirds of our outstanding common stock.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF AN AMENDMENT TO ARTICLE II, SECTION 1, OF THE COMPANY’S AMENDED CODE OF REGULATIONS, AND THE ADDITION OF ARTICLE EIGHTH TO THE AMENDED ARTICLES OF INCORPORATION, TO REQUIRE THE ELECTION OF DIRECTORS TO RECEIVE A MAJORITY VOTE IN UNCONTESTED ELECTIONS, OR A PLURALITY VOTE IN CONTESTED ELECTIONS. PROXY CARDS RECEIVED BY THE COMPANY WILL BE VOTED “FOR” PROPOSAL 2 UNLESS THE SHAREHOLDER SPECIFIES OTHERWISE ON THE PROXY CARD.

PROPOSAL 3

AMENDMENT TO THE COMPANY’S AMENDED CODE OF REGULATIONS TO PROVIDE

FOR THE REMOVAL OF DIRECTORS BY A SIMPLE MAJORITY

Our board of directors recommends that shareholders approve an amendment to the Code to reduce the threshold for shareholder removal of a director from a two-thirds supermajority to a simple majority. The adoption of this standard is intended to reinforce the board’s accountability to the interests of shareholders and to reflect emerging corporate governance best practices. The text of the amendment to the Code is set forth in Annex B to this Proxy Statement.

Empowering shareholders to remove directors by a simple majority will ensure that all directors maintain sufficient support among, and accountability to, our shareholders. In fact, director removal by majority vote of shareholders is expressly provided for by Delaware law, which governs a majority of publicly traded corporations in the United States, and, as such, many public corporations have already adopted such a provision.

Vote Required

Adoption of the amendment to the Code requires the affirmative vote of two-thirds of our outstanding Common Stock.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF AN AMENDMENT OF ARTICLE II, SECTION 6, OF THE COMPANY’S AMENDED CODE OF REGULATIONS TO REDUCE THE THRESHOLD NEEDED TO REMOVE A DIRECTOR FROM A TWO-THIRDS MAJORITY TO A SIMPLE MAJORITY. PROXY CARDS RECEIVED BY THE COMPANY WILL BE VOTED “FOR” PROPOSAL 3 UNLESS THE SHAREHOLDER SPECIFIES OTHERWISE ON THE PROXY CARD.

BENEFICIAL OWNERSHIP OF COMMON SHARES

The following table shows the number of common shares beneficially owned as of June 25, 2019, , by (i) each current director; (ii) our Named Executive Officers employed with the Company on June 25, 2019; (iii) all directors and executive officers as a group; and (iv) each person who is known by us to beneficially own more than 5% of our common shares.

|

| | | | | | | | | | | | |

Name |

Common Shares | Shares Subject to Exercisable Options |

Restricted Shares (1) | Total Shares Beneficially Owned (1) |

Percent of Class (2) |

| Directors and Nominees | | | | | |

| Donald Colvin | 21,736 |

| | — |

| | 3,308 |

| | 25,044 | | * |

| Dana Jones | — |

| | — |

| | 3,308 |

| | 3,308 | | * |

| Jerry Jones | 46,676 |

| | — |

| | 3,308 |

| | 49,984 | | * |

| Michael A. Kaufman (3) | 2,408,757 |

| | — |

| | — |

| | 2,408,757 | | 10.3 |

| Keith M. Kolerus | 135,253 |

| | — |

| | 3,308 |

| | 138,561 | | * |

| Melvin Keating | 25,580 |

| | — |

| | 3,308 |

| | 28,888 | | * |

| John Mutch | 30,970 |

| | — |

| | 3,308 |

| | 34,278 | | * |

| Named Executive Officers | | | | | |

| Ramesh Srinivasan | 204,348 |

| | 525,000 |

| | 30,120 |

| | 759,468 | | 3.2 |

| Tony Pritchett | 28,508 |

| | 30,174 |

| | 12,827 |

| | 71,509 | | * |

| Kyle Badger | 90,624 |

| | 87,466 |

| | 8,529 |

| | 186,619 | | * |

| Prabuddha Biswas | 9,440 |

| | 10,615 |

| | 28,328 |

| | 48,383 | | * |

| Don DeMarinis | 5,403 |

| | 4,423 |

| | 10,288 |

| | 20,114 | | * |

| All directors and executive officers | 3,038,328 |

| | 695,843 |

| | 162,228 |

| | 3,896,399 | | 16.1 |

| Other Beneficial Owners | | | | | |

BlackRock, Inc.

55 East 52nd Street

New York, New York 10055 | 2,569,881 (4) |

| | | | | 10.9 |

Bermuda One Fund LLC

c/o MQ Services Ltd. Victoria Place 31 Victoria Street, Hamilton, HM10, Bermuda | 2,460,400 (5) |

| | | | | 10.5 |

MAK Capital One, LLC et al

590 Madison Avenue, 9th Floor

New York, New York 10022 | 2,408,757 (6) |

| | | | | 10.3 |

Dimensional Fund Advisors LP Building One

6300 Bee Cave Road

Austin, Texas, 78746 | 1,772,134 (7) |

| | | | | 7.5 |

| The Vanguard Group, Inc. PO Box 2600 V26 Valley Forge, PA 19482-2600 | 1,197,964 (8) |

| | | | | 5.1 |

William Blair Investment Management, LLC

150 North Riverside Plaza

Chicago, IL 60606 | 1,179,416 (9) |

| | | | | 5.0 |

| |

| (1) | Beneficial ownership of the shares comprises both sole voting and dispositive power or voting and dispositive power that is shared with a spouse, except for restricted shares for which individual has sole voting power but no dispositive power until such shares vest. |

| |

| (2) | * indicates beneficial ownership of less than 1% on June 25, 2019. |

| |

| (3) | Comprised entirely of shares beneficially owned by MAK Capital One LLC. Mr. Kaufman is the managing member of MAK Capital One LLC and shares voting and dispositive power with respect to all the shares. |

| |

| (4) | As reported on a Schedule 13G/A dated January 2, 2019. Blackrock, Inc. has sole voting power with respect to 2,544,831 shares and sole dispositive power with respect to all the shares. |

| |

| (5) | As reported on a Form 4 filed June 24, 2019. VP Bermuda LLC is the managing member of Bermuda One Fund LLC, and Scott D. Vogel is the Managing Member of VP Bermuda LLC. Bermuda Fund, VP Bermuda LLC and Mr. Vogel have shared power to vote or direct the vote the shares held by Bermuda One Fund LLC. The principal business address of VP Bermuda LLC and Mr. Vogel is c/o McCarter & English, LLP, 825 Eighth Avenue, 31st Flr., New York, NY 10019. |

| |

| (6) | As reported on a Schedule 13D/A dated February 14, 2019. MAK Capital One LLC has shared voting and dispositive power with respect to all the shares. MAK Capital One LLC serves as the investment manager of MAK Capital Fund LP (“MAK Fund”) and MAK-ro Capital Master Fund LP (“MAK-ro Fund”). MAK GP LLC is the general partner of MAK Fund and MAK-ro Fund. Michael A. Kaufman is managing member and controlling person of MAK GP LLC and MAK Capital One LLC MAK Fund, MAK-ro Fund, MAK Capital and MAK GP hold 1,605,365 shares (representing 6.8% of the outstanding shares), 513,840 shares (representing 2.2% of the outstanding shares), 118,523 shares (representing 0.5% of the outstanding shares) and 171,029 shares (representing 0.7% of the outstanding shares), respectively. Each of MAK Fund and MAK-ro Fund shares voting power and investment power with MAK Capital, MAK GP and Mr. Kaufman. Each of MAK Capital and MAK GP shares voting power and investment power with Mr. Kaufman. The principal business address of MAK Capital One LLC, MAK GP LLC and Mr. Kaufman is 590 Madison Avenue, 9th Floor, New York, New York 10022. The principal address of MAK Fund is c/o Dundee Leeds Management Services Ltd., 129 Front Street, Hamilton, HM 12, Bermuda. The principal business address of MAK-ro Fund is c/o Dundee Leeds Management Services Ltd., Waterfront Centre, 2nd Floor, 28 N. Church Street, P.O. Box 2506, Grand Cayman KY1-1104, Cayman Islands. |

| |

| (7) | As reported on a Schedule 13G/A dated February 8, 2019. Dimensional Fund Advisors LP has sole voting power with respect to 1,687,695 shares and sole dispositive power with respect to all the shares. |

| |

| (8) | As reported on a Schedule 13F filed May 15, 2019. |

| |

| (9) | As reported on a Schedule 13F filed May 10, 2019. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires the Company’s directors and certain of its executive officers and persons who beneficially own more than 10% of the Company’s common shares to file reports of and changes in ownership with the SEC. Based solely on the Company’s review of copies of SEC filings it has received or filed, the Company believes that each of its directors, executive officers, and beneficial owners of more than 10% of the shares satisfied the Section 16(a) filing requirements during fiscal year 2019, other than: due to miscommunication between Mr. Kolerus and the Company, Mr. Kolerus filed a Form 4 on September 17, 2018 for the sale of 14,317 shares that included transactions that were reported 1 and 2 days late, he filed a Form 4 on February 21, 2019 for the sale of 8,400 shares that included transactions that were reported between 3 and 23 days late, and he filed a Form 4 on [June 26], 2019 for the sale of 783 shares that should have been filed in August and December 2018.

EXECUTIVE OFFICERS

The following are biographies for each of our current, non-director executive officers. The biography for Mr. Srinivasan, our President and Chief Executive Officer, and a director, is provided above.

|

| | | |

| Name | Age | Current Position | Previous Positions |

| Tony Pritchett | 3537 | Vice President and Chief Financial Officer since June 2017. | Interim Vice PresidentChief Financial Officer from November 2016 tountil June 2017. Senior Director of Operations from March 2015 tountil November 2016, Controller from August 2013 tountil March 2015, and Divisional Controller of the Retail Solutions Group from January 2012 tountil August 2013. Controller of Cypress Communications from October 2011. |

| Kyle C. Badger | 4951 | Senior Vice President, General Counsel and Secretary since October 2011. | Executive Vice President, General Counsel and Secretary at Richardson Electronics, Ltd. from 2007 tountil October 2011. |

Rehan JaddiPrakash Bhat | 4554 | Vice President and Managing Director, India, since March 2017. | Vice President, India Operations, at Radial Omnichannel Technologies India, from November 2015 until March 2017. Vice President, Bally Technologies India, from September 2005 to August 2014. |

| Prabuddha Biswas | 59 | Senior Vice President, Customer SupportChief Technology Officer since April 2018. | Chief Technology Officer, Alert Logic, from August 2015 until April 2018. Vice President of Engineering, Airbiquity, from June 2013 until August 2015. Senior Vice President of Engineering, Medio Systems, from June 2011 until June 2013. |

| Don DeMarinis | 55 | Senior Vice President Sales, Americas, since January 2018. | Chief Commercial Officer, Global, QikServe Limited, from April 2017 until January 2018. Executive Vice President/Chief Revenue Officer, Gusto, from June 2016 until April 2017. Vice President, Sports & Service Solutions, since December 2014.Entertainment Business Unit, Oracle, September 2014 until June 2016. |

| Heather Varian Foster | 47 | Vice President of Product Engineering,Marketing since March 2018. | Vice President, Marketing, Worldpay, from January 2017 until February 2018. Vice President, Marketing, StrataCloud, from May 2014 until December 2016. Vice President Marketing, ControlScan, from December 2007 until May 2014. |

| Robert Jacks | 61 | Vice President and Chief Information Officer since July 2018. | Vice President of Professional Services from June 2012 to2015 until July 2018. President, Robert L. Jacks & Associates, LLC, from August 2013 until June 2015. Chief Information Officer, Chickasaw Nation, August 2005 until July 2013. |

| Jeba Kingsley | 46 | Vice President, Professional Services since December 2018. | Vice President, Global Services, Scientific Games, from November 2014 until November 2017. Vice President, Professional Services, Bally Technologies, from March 2013 until November 2014. Principal Group Program ManagerSenior Director, Professional Services, Bally Technologies, from March 2006 until February 2013. |

| Sridhar Laveti | 52 | Vice President of Established Products and Customer Support since September 2017. | Vice President, Business Transformation from May 2017 until September 2017. Senior Vice President, Gaming Systems, at MicrosoftBally Technologies from 2004 to 2012.December 2014 until September 2017. Senior Vice President, Bally Technologies, from April 2006 until December 2014. |

| Chris Robertson | 4648 | Vice President, Corporate Controller and Treasurer, since June 2017.2019. | Corporate Controller and Treasurer from June 2017 until June 2019. Corporate Controller from February 2017 tountil June 2017. Managing Director at Grant Thornton LLP from 2010 tountil January 2017. |

Larry Steinberg | 49 | Senior Vice President and Chief Technology Officer since June 2012. | Principal Development Manager, Microsoft Corporation from August 2009 to May 2012, and Principal Architect from June 2007 to July 2009; Founder and Chief Technology Officer of Engyro Corporation from March 1995 to May 2007. |

Jimmie Walker | 57 | Senior Vice President, Global Revenue since January 2016. | Vice President, Sales and Marketing November 2014 to January 2016. Vice President of Sales, Codeforce 360 from May 2013 to October 2014. Business Development Principal, Edutainment Media from October 2005 to May 2013. |

BENEFICIAL OWNERSHIP OF COMMON SHARES

The following table shows the number of common shares beneficially owned as of July 7, 2017, by (i) each current director; (ii) our Named Executive Officers employed with the Company on July 7, 2017; (iii) all directors and executive officers as a group; and (iv) each person who is known by us to beneficially own more than 5% of our common shares.

|

| | | | | | | | | | | |

Name |

Common Shares | Shares Subject to Exercisable Options |

Restricted Shares (1) | Total Shares Beneficially Owned (1) |

Percent of Class (2) |

| Directors and Nominees | | | | | |

| Donald Colvin | 9,349 | | — |

| | 7,113 |

| | 16,462 | | * |

| Jerry Jones | 34,289 | | — |

| | 7,113 |

| | 41,402 | | * |

| Michael A. Kaufman (3) | 7,056,934 | | — |

| | — |

| | 7,056,934 | | 30.3 |

| Keith M. Kolerus | 147,566 | | — |

| | — |

| | 147,566 | | * |

| Melvin Keating | 13,193 | | — |

| | 7,113 |

| | 20,306 | | * |

| John Mutch | 18,583 | | — |

| | 7,113 |

| | 7,113 | | * |

| Named Executive Officers | | | | | |

| Kyle C. Badger | 46,498 | | 74,566 |

| | 57,177 |

| | 178,241 | | * |

| Tony Pritchett | 8,141 | | 6,328 |

| | 28,701 |

| | 43,170 | | * |

| Ramesh Srinivasan | 60,000 | | — |

| | 91,463 |

| | 151,463 | | * |

| Larry Steinberg | 113,849 | | 102,444 |

| | 80,644 |

| | 296,937 | | 1.3 |

| Jimmie Walker, Jr. | 4,567 | | 9,525 |

| | 95,509 |

| | 109,601 | | * |

| All directors and executive officers | 7,542,340 | | 215,473 |

| | 432,061 |

| | 8,175,648 | | 34.7 |

| Other Beneficial Owners | | | | | |

MAK Capital One, LLC et al 590 Madison Avenue, 9th Floor New York, New York 10022 | 7,056,934 (4) | | | | 30.3 |

RGM Capital, LLC 9010 Strada Stell Court, Suite 105 Naples, FL 34109 | 2,256,143 (5) | | | | 9.7 |

Dimensional Fund Advisors LP 6300 Bee Cave Road Building One Austin, Texas, 78746 | 1,853,517 (6) | | | | 8.0 |

BlackRock, Inc. 55 East 52nd Street New York, New York 10055 | 1,850,929 (7) | | | | 7.9 |

Discovery Group I, LLC 300 South Wacker Drive, Suite 600 Chicago, Illinois 60606 | 1,581,797 (8) | | | | 6.8 |

| |

(1) | Beneficial ownership of the shares comprises both sole voting and dispositive power, or voting and dispositive power that is shared with a spouse, except for restricted shares for which individual has sole voting power but no dispositive power until such shares vest. |

| |

(2) | * indicates beneficial ownership of less than 1% on July 7, 2017. |

| |

(3) | Comprised entirely of shares beneficially owned by MAK Capital One L.L.C. Mr. Kaufman is the managing member of MAK Capital One L.L.C. and shares voting and dispositive power with respect to all of the shares. |

| |

(4) | As reported on a Schedule 13D/A dated May 12, 2015. MAK Capital One LLC has shared voting and dispositive power with respect to all of the shares. MAK Capital One LLC serves as the investment manager of MAK Capital Fund LP (“MAK Fund”) and MAK-ro Capital Master Fund LP (“MAK-ro Fund”). MAK GP LLC is the general partner of MAK Fund and MAK-ro Fund. Michael A. Kaufman, managing member and controlling person of MAK GP LLC and MAK Capital One L.L.C., has shared voting and dispositive power with respect to all of the shares. MAK Fund has shared voting and dispositive power with respect to 3,424,973 shares. MAK-ro Fund has shared voting and dispositive power with respect to |

1,859,675 shares. Paloma International L.P. (“Paloma”), through its subsidiary Sunrise Partners Limited Partnership, and S. Donald Sussman, controlling person of Paloma, have shared voting and dispositive power with respect to 1,772,286 shares. The principal business address of MAK Capital One LLC, MAK GP LLC and Mr. Kaufman is 590 Madison Avenue, 9th Floor, New York, New York 10022. The principal address of MAK Fund is c/o Dundee Leeds Management Services Ltd., 129 Front Street, Hamilton, HM 12, Bermuda. The principal business address of MAK-ro Fund is c/o Dundee Leeds Management Services Ltd., Waterfront Centre, 2nd Floor, 28 N. Church Street, P.O. Box 2506, Grand Cayman KY1-1104, Cayman Islands. The principal address of Paloma and Sunrise Partners Limited Partnership is Two America Lane, Greenwich, Connecticut 06836-2571. The principal business address for Mr. Sussman is 217 Commercial Street, Portland, Maine 04101.